What does contractors insurance cover?

By My Service Depot on Tuesday, April 9, 2019Find out what contractors insurance does, what kind you might need, and how you can start using it.

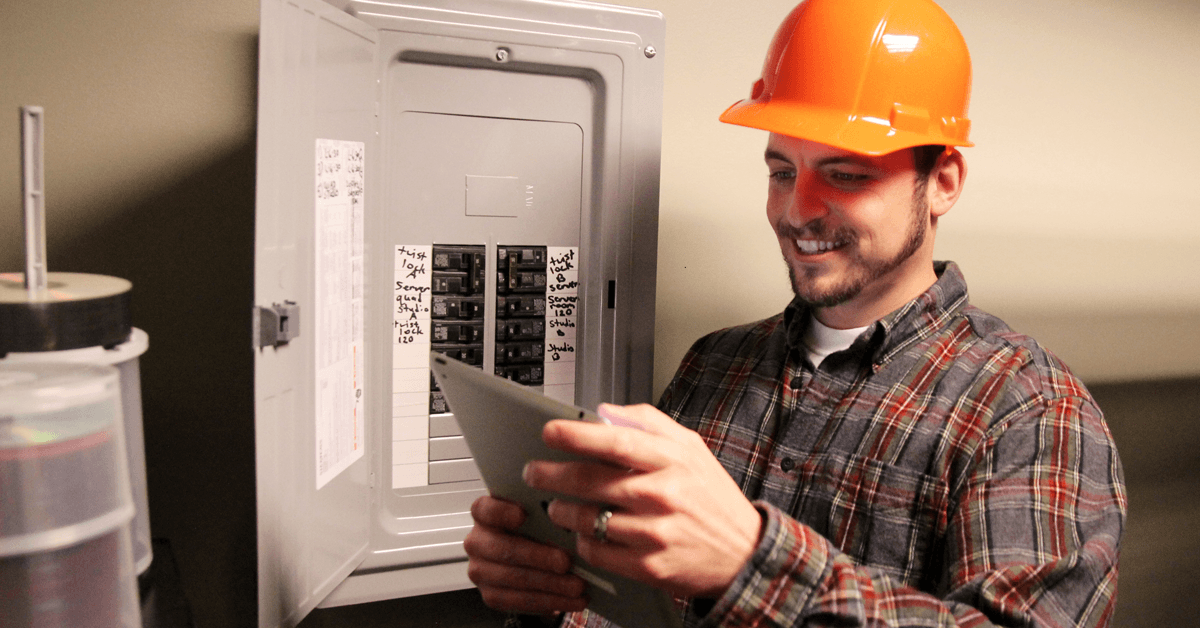

If you work in the construction business, you already have firsthand experience of the demands of the industry: physically, mentally, and financially. Good builders prioritize protecting their business and their clients from the potential risks that occur during and even after a project. One way to accomplish this? Make adequate and necessary insurance policies a top priority.

Even the best construction team is not safe from accidents and misfortunes. Some circumstances you simply do not have control over. You’ll never know when a crew member might trip and fall or when some machinery will fail you. In any case, it pays to constantly remain protected.

How does contractor’s insurance work?

A number of policies protect contractors from the risks that they may face while running their business. Three of the most common policies that contractors use are general liability insurance, builder’s risk insurance, and worker’s compensation insurance. Contractors can add other policies to this list as they see fit, but these three are the most critical.

Contractors insurance, however, is a term commonly used to refer to what is arguably the most critical coverage on the list—general liability (GL) insurance.

Basically, GL insurance offers coverage for all sorts of third-party claims. This includes complaints and lawsuits by the clients or affected parties in case of damages or accidents at the job site.

Contractors liability insurance serves as an excellent way to protect your business from going bankrupt. So, what does it cover?

Medical Expenses for Third-party Injuries

What if during a remodeling project, a guest comes over, accidentally trips on a wire and hits their head hard on the driveway? Who will foot the medical bill? If you have GL insurance, then you have little to worry about—financially, at least.

Your general liability insurance will cover the medical expenses and any lawsuits that may result from the third-party injury. If the worst happens, the policy will pay for the funeral and the financial compensation that goes with it as ordered by the court.

Products and Completed Operations

Did you know that even a job you’ve completed long ago can still put you at risk of a lawsuit? If it turns out that a part of the project failed and caused harm because of a defect, you can get sued.

The GL insurance policy will also cover the expenses in the event that a part of your completed project fails and causes third-party injury. However, the coverage is often only in place for the duration of your policy. Once canceled, it will not compensate you for any future project-related injury claims.

Damage to Other’s Property

You accidentally wrecked the neighbor’s driveway while doing a remodeling job next door. What happens now? Well, if you don’t have insurance, then you’ll have to dig into your pocket to pay for it or the possible lawsuit that’ll go with it. But if you have contractors liability insurance, you’re protected from property damage claims and lawsuits.

Personal and Advertising Injuries

Apparently, even trying to promote your services can put your construction business in a tight spot! Advertising injuries represent a genuine threat, especially in the age of the internet and social media.

A Facebook post, a very short tweet, an online ad—these things can get you sued. How? Copyright infringement, slander, libel, and false claims… these represent but a few examples of how you can get yourself in an advertising mess these days.

The internet has made brand and service promotion both easier and trickier at the same time. If someone accuses you of causing harm or defamation through your advertising efforts, you’ll be glad you have GL insurance.

Exercising caution before putting anything out there can prevent advertising mishaps, but general liability insurance can save you and pull you out if you ever find yourself in a hole.

What It Doesn’t Cover

Just like everything else, contractors liability insurance also has its limitations. Set limits exist for each occurrence and aggregated values. One thing that the insurance does not cover? Poor workmanship or anything related to “work.” It won’t pay for the medical expenses of injured workers either—you’ll need some other insurance coverage for this.

Licensed, Bonded, Insured

If you wish to truly protect your interests and further your credibility in the industry, general liability insurance alone won’t be enough. Ideally, you must also have builder’s risk insurance and workers compensation insurance to supplement the coverage of your GL policy.

Clients these days are more aware of the risks that come with construction projects. They look to hire reputable contractors with adequate insurance coverage and often cross-check with the insurance provider to make sure everything is authentic and valid.

In this industry, reputation can be a game changer. If you want to grow your business, invest in your brand. Insurance is just one of the factors. Be licensed, insured, and bonded, too!