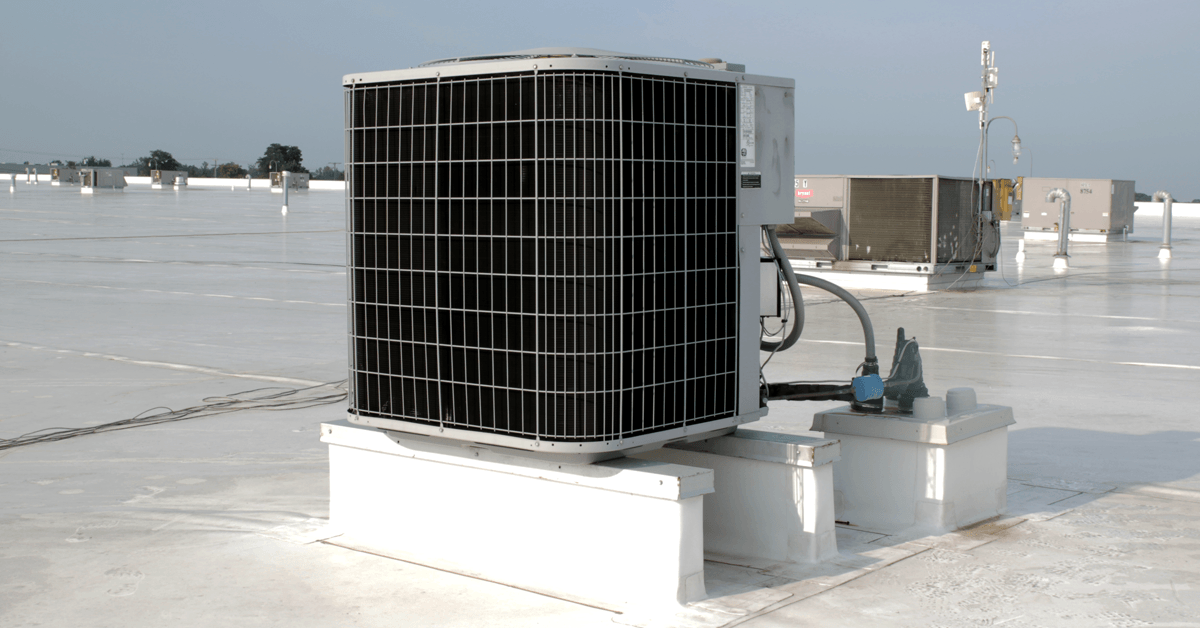

How to Start Your HVAC Business with Bad Credit

By My Service Depot on Wednesday, November 28, 2018Bad credit? Don't despair! You might yet start that HVAC business.

It’s a cliche, but let’s face it, it really does cost money to make money! So where do you start when your credit isn’t perfect and you don’t have access to a ton of startup capital?

Without excellent credit, you’ll face greater challenges when you need to get a business going. Of course, that doesn’t make it impossible, you can still start an HVAC business in spite of a bad credit score. Keep reading and we’ll discuss some strategies.

It’s All About The Money

First, we’ll look at how much cash you really need. According to Entrepreneur Magazine, you can expect to shell out between $2,000 and $10,000 dollars to finance your dreams. For some HVAC entrepreneurs, those costs end up topping $100k.

That’s a lot of dough! What is this money paying for, exactly? A lot of things:

- Equipment: Tools, a truck, etc.

- Office: The location you use to work, interact with customers, and maybe house the truck now and then.

- Employees: Maybe you’ll start off without employees, but if you get really busy that can change quickly.

- Licenses: Fees, recurring costs, and one-time charges for getting licensed in your state and local area.

- Other: Marketing, uniforms, a website, HVAC software, and any misc. things you need for your business.

You can minimize or trim down some of these costs, but even if you do, you’ll probably still need financing.

Credit SOS

First of all, once you decide to start a business, you need to start taking care of that credit. Even if your credit is in shambles and seems like a lost cause, you definitely don’t want to make it worse. Use a free site like Credit Karma to discover the state of your credit and determine how to start fixing it.

Follow the usual advice and start making regular payments (even just minimum payments) and communicate with your lenders. You could also seek out advice from a credit counselor.

Getting Financed

Even people with a bad credit history can sometimes find a lender willing to take a risk. A lot of people picture bank loans when they get started. There’s a popular perception that if you can’t find a bank that will give you a business loan, you can’t find a lender, period.

That’s just a misconception about how entrepreneurship is actually financed. Truthfully, banks just behave in a picky manner. So picky, in fact, that most new businesses don’t primarily rely on them. If you strike out with the banks, take this fact as encouragement. Entrepreneur reports that only 25 percent of new business owners’ early financing comes from credit cards and banks, meaning the other 75 percent comes from sources that don’t necessarily have the same stringent credit practices.

So, it’s not impossible after all.

Up Your Chances of Getting Approved

If you want to, try getting a bank loan first, then move on to nontraditional forms of credit (like the ones listed in the next section; non-traditional credit excludes traditional bank loans and may include crowdsourced lending from many sources or modified terms offered by banks to make loans more affordable and accessible to more borrowers). Use this process to increase your chances:

- Create a business plan. It doesn’t have to be fancy, but you do want to demonstrate to potential lenders that you’re serious and capable of doing great things. You can find templates and ideas online. Basically, you have to document your potential market, what you plan to offer, and how you’ll get the work done.

- Show responsibility. Even if you can’t pay all of your bills, make an effort to show that you’ve done your best. Lenders want to know that when you do succeed with your new business, you’ll pay back your old loans. (Otherwise, why would they give you money?) Pay $5 on a bill if you have to and explain the situation if you have an overdue bill—the creditor may be able to work out an arrangement so you can get back on track again.

- Invest yourself. Lenders want to see you put your money where your mouth is. If you need a $5,000 loan and have poor credit, you may still show how much you believe in your business if you take the small amount you do have and invest it in your new company.

What happens if I’m rejected or don’t get enough capital?

You followed our tips, and you still don’t have the money you need or you didn’t get enough. Now it’s time to start bootstrapping your business and turning to nontraditional sources.

Consider these other options:

- Microloans: Originally created for people living in third-world countries, microloans have come to the US for small businesses. Some banks will willingly loan smaller sums even if they turned you down for a full loan. You can also find a microlender online with a little research.

- Peer-To-Peer Financing: With the internet, people now loan small amounts of money (sometimes together with other individuals) to create a full loan product. You may find viable options from places like The Lending Club. Because you’re borrowing from other people instead of a bank, you may find more lenient requirements and more options, even with bad credit.

- Partnership: Many small businesses start out as partnerships to lighten the financial load or provide access to money. Remain careful and go into these arrangements with a contract spelling out the terms and responsibilities of each partner.

- Friends and Family: If you can, you could always ask people you know for a loan. Write up a contract anyway, just to stay on the safe side. If your business takes off, you’ll want the results of that success spelled out.