How will the new tariffs impact field service companies?

By Madison Capitano on Monday, August 27, 2018Tariffs are everywhere in the news lately. And whether you’ve felt the effects or not, they’re everywhere in the market now too. Here’s what you need to know about them!

If you’ve ventured anywhere near the news lately, you’ve seen the term “tariff” bandied about. Most likely, this brought back vague flashbacks of a long forgotten high school economics exam, one on concepts that you never imagined would ever impact your daily life. Well, unfortunately, now they might. But, don’t worry! We’ve got your back.

I’m not a politician. I don’t have a major in political science. Or economics. Or global relations. Basically, I am not here to say we should or shouldn’t be knee-deep in this tariff thing, I’m just here to talk about the facts and how they relate to you. Or more importantly, how they relate to your business.

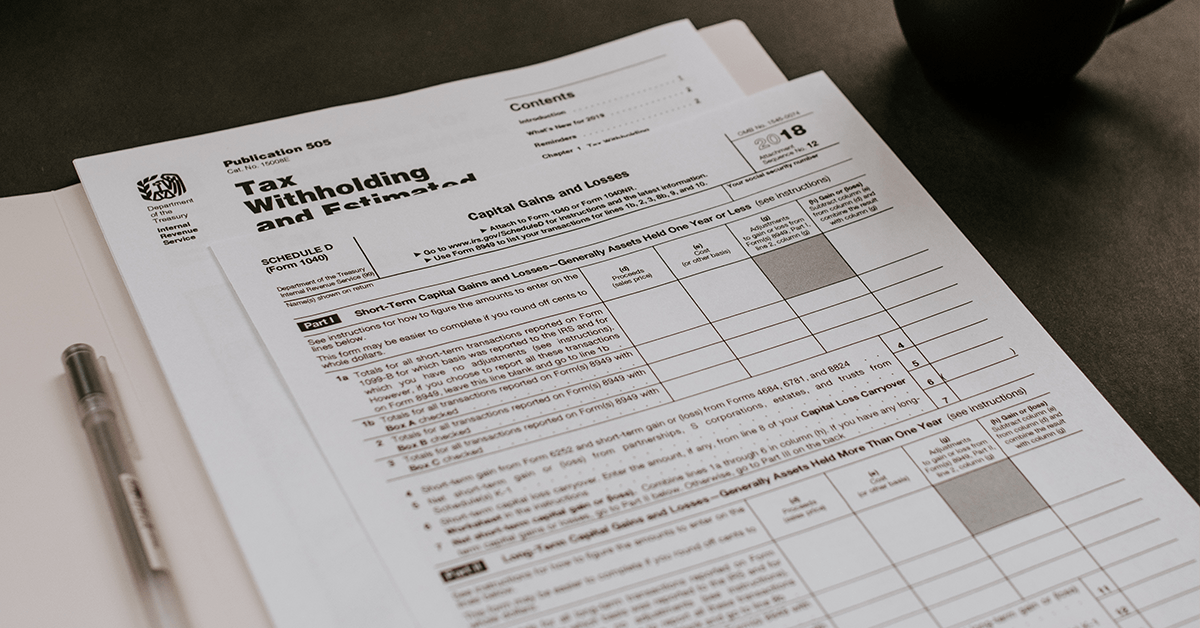

What is a tariff? How do tariffs work?

Firstly, a tariff is a fee levied on foreign imported goods. It’s basically a border tax, and if a country wants to sell goods to another country, they have to pay it. This is generally done to make the competing domestic product more appealing, or make foreign prices more similar to domestic prices (eliminating incentives to buy from foreign vendors).

Due to free trade agreements, tariffs have been declining steadily for the last couple decades. At the start of 2018, globally, tariffs were close to their lowest levels ever—averaging around 2.9 percent.

How did this start?

The trend in declining tariffs reversed when, in order to bolster American steel and aluminum companies, President Trump put tariffs on those products: a 25 percent tariff on steel and a 10 percent tariff on aluminum (even for Canada, Mexico, and the European Union). The U.S. and China have been levying tariffs against each other ever since at increasing rates and on an increasing amount of goods. The current tally of goods affected by the new tariffs is $34 billion.

Historically speaking, once tariffs are in place they can be pretty hard to shake. For example, the U.S. actually has a 25 percent tariff on imported trucks that goes back to the “Chicken War” of 1963. During this conflict, the European Union kept our chicken out of their markets, and in retaliation we imposed a 25 percent tariff on trucks that continues today.

What tariffs have been levied?

There are over 10,000 items affected by the new tariffs, including the steel and aluminum mentioned earlier. As fascinating as I know it would be to wade through the thousands of minute details, I’m just going to hit on the big ones that will most impact service industries like HVAC, plumbing, electrical, and construction.

The steel and aluminum tariffs have gotten the most spotlight, and for good reason. This was seen as a win for domestic industries that supplied those metals. It managed to breathe a bit of new life into an industry that’s struggled for years. This has had the intended effect of removing foreign products from store shelves, but if you regularly buy anything with steel or aluminum in it (pipes, nails, screws, ducts, etc.) you probably have seen, and will likely continue to see, a rise in price. Why? The demand for goods of this nature far outstrips current domestic supply.

Along with any industry that relies on aluminum and steel to create its products, these goods are also more expensive and harder to get a hold of:

- Many materials related to the automobile industry

- Metal-rolling mills

- Molds for glass, rubber, or plastics (and the parts those molds make)

- Railway track fixtures

- Electric welding apparatus

- Some machine parts

- Parts of equipment for checking semiconductor devices

- Some microscopes and telescopes

- Denim

What does this mean for my business?

Prices are rising and will probably keep doing so the longer the trade dispute continues.

Hercules Industries, a manufacturer and distributor of HVAC sheet metal, released a statement on March 20 stating they would have to implement a 6 percent increase on all nonmaterial-intensive products and a 12 percent increase on material-intensive products due to the steel and aluminum tariffs. Despite maintaining good relationships with domestic steel mills, even companies like Hercules Industries aren’t immune to the new tariffs.

Nearly every business in the service industry has to deal with the effects of these tariffs. So far, some individual service businesses have raised their pricing to match the increasing costs of materials., Others, not wanting to risk customers by raising their rates, have decided to eat the additional cost in the hopes that the trade dispute will be settled soon.

Is the end in sight?

There’s no shortage of experts weighing in. Scott Kennedy, Director of the Project on Chinese Business and Political Economy at the Center for Strategic and International Studies, thinks that the aggressive tariffs might settle in for a longer stay than many would hope due to the unclear end-goals and general stubbornness surrounding the issue. Others, like Joshua Meltzer, Senior Fellow in the global economy and development program at the Brookings Institution, think that given the infancy of this trade dispute, there’s a chance everything could settle down if the countries involved can formally articulate a realistic set of demands to each other.

What should I do?

At the end of the day none of us will be signing any bills to change, abolish, or strengthen the tariffs. For now, we just have to deal with the fallout: increased prices on certain items. If you think these rates are here to stay, you may want to consider adjusting your own prices. If not, ride, ride the storm until a more certain outcome becomes clear. Either way, you will probably want to stay informed on the issue. Find and bookmark relevant resources (like this blog!) and check them regularly for updates.