Field management software for the service trades

Field Management

Work Smarter, Not Harder

software

for the Service Trades

Smart Service is a cutting-edge, cloud-based field service management solution with your trade in mind. Sell, schedule, route, and invoice jobs with ease.

.webp)

Access your business from anywhere, keep your team connected, and supercharge your profits.

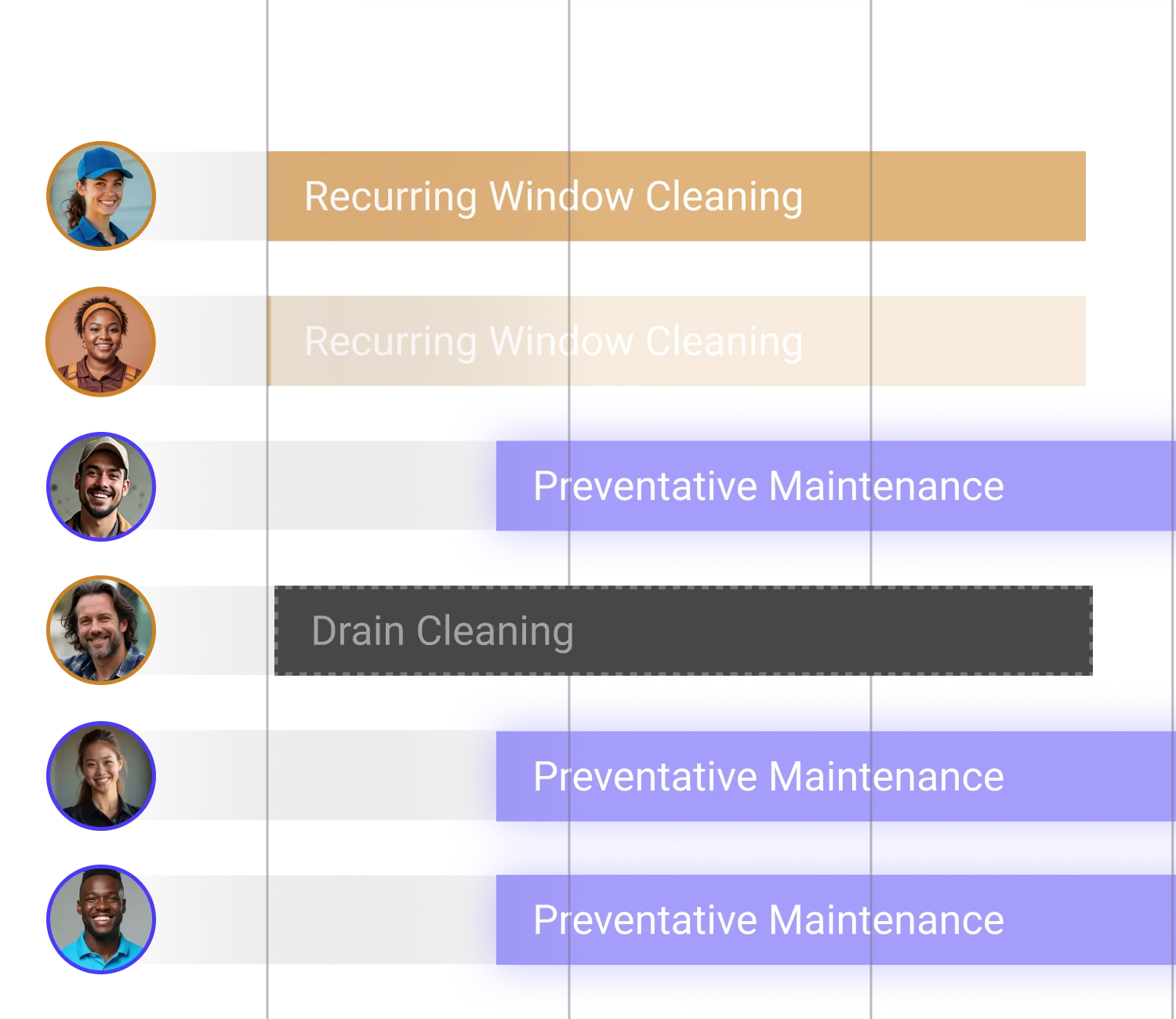

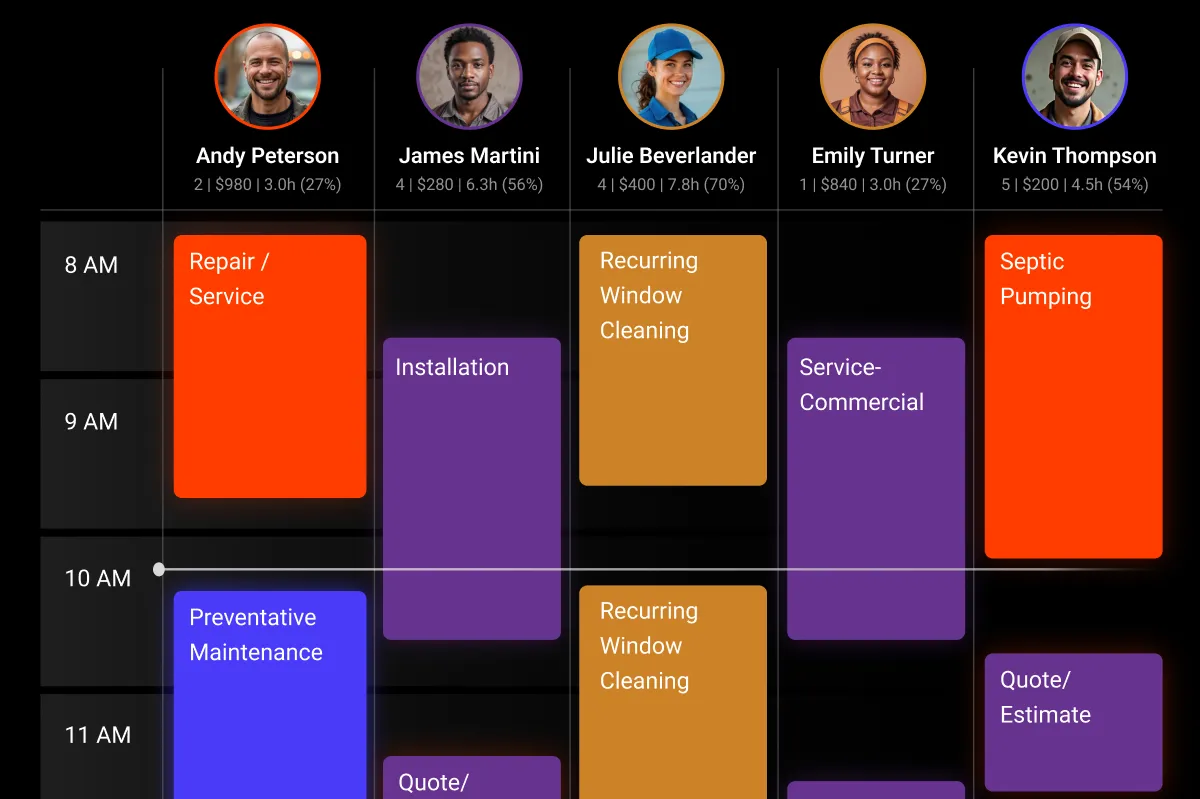

Schedule the CUSTOMER

From drag-and-drop scheduling to real-time updates and automated dispatching, Smart Service ensures every appointment, employee, crew, and asset is in the right place at the right time.

.webp)

.webp)

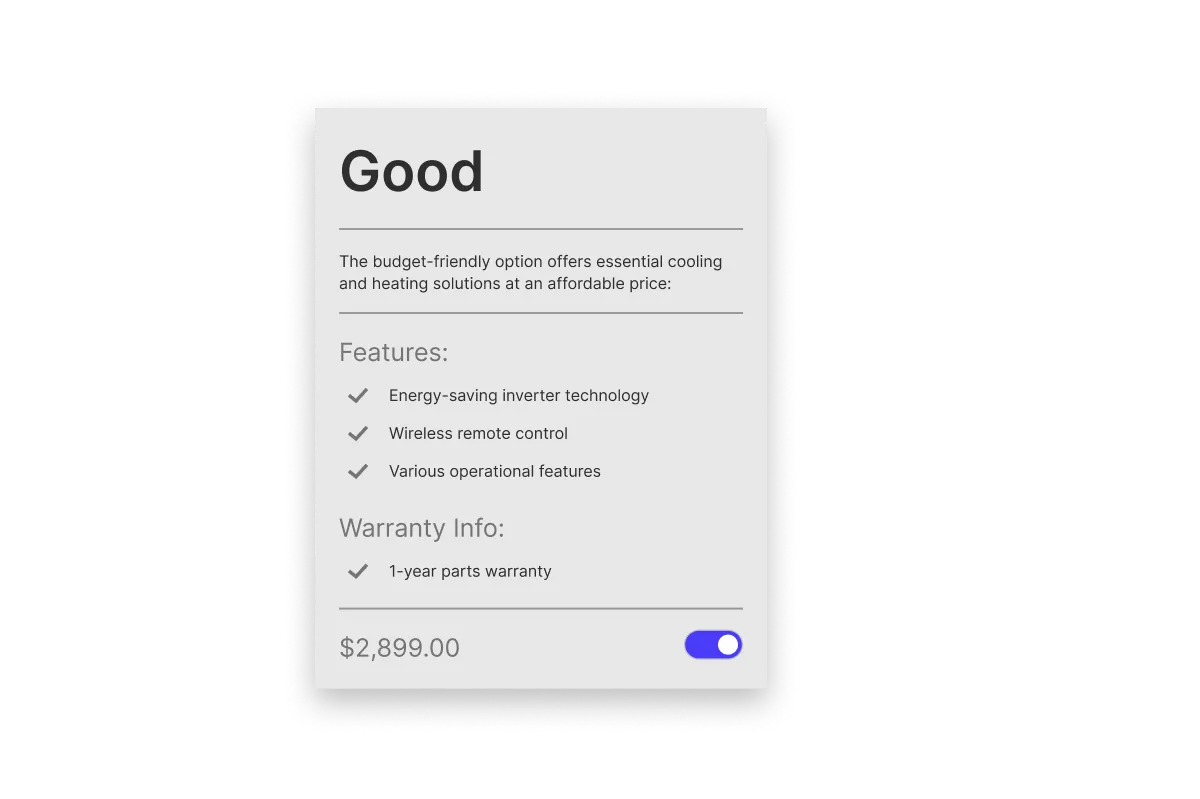

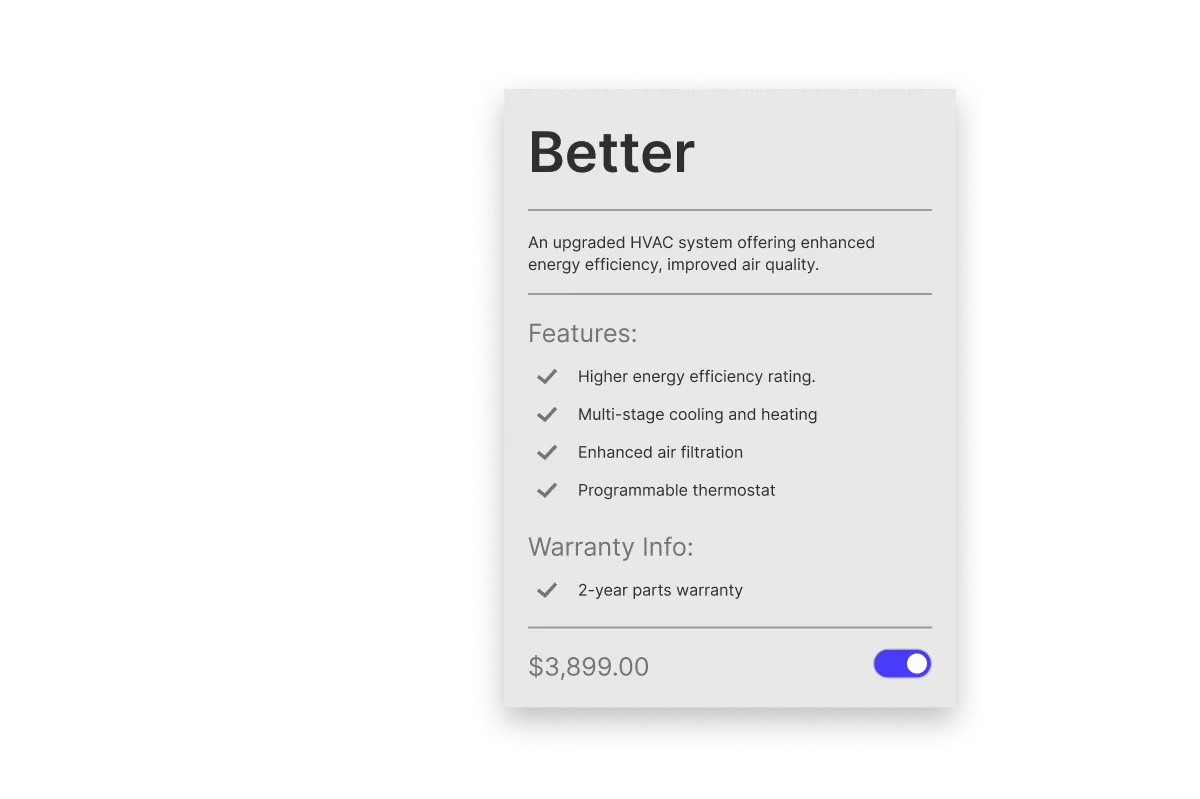

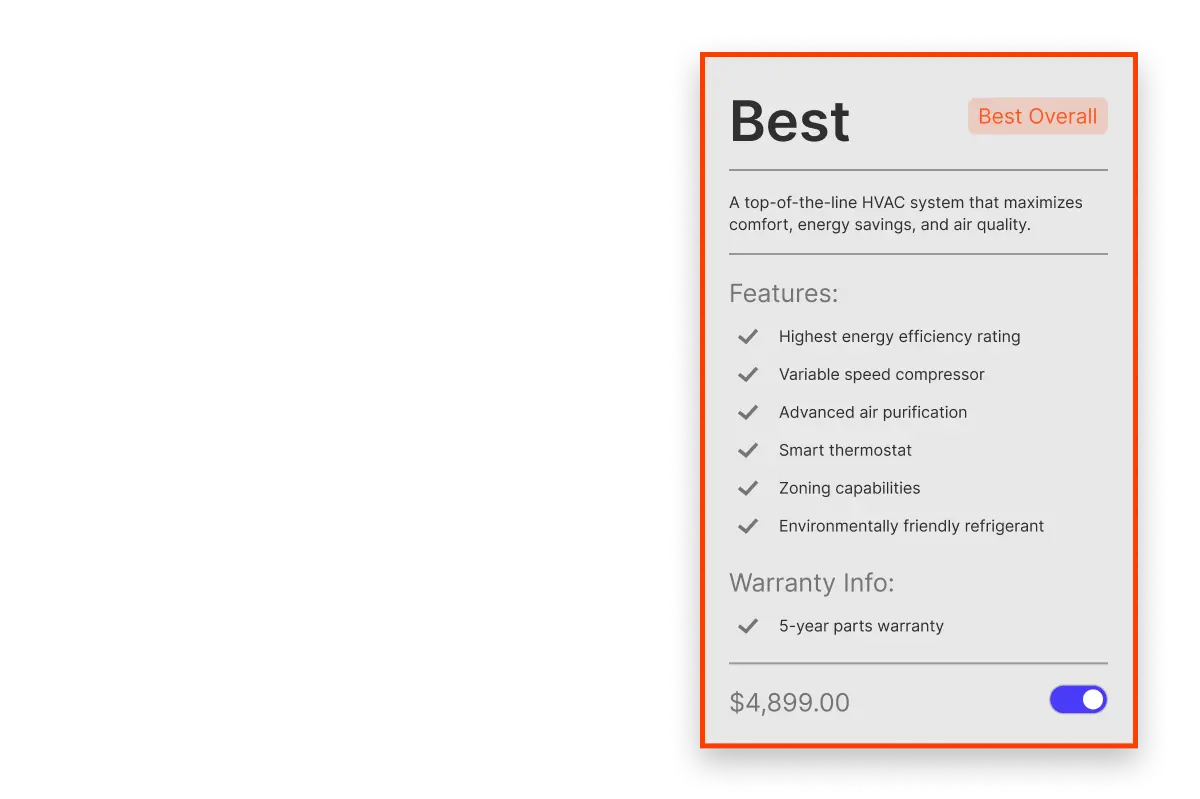

Sell

Close deals faster with Smart Service’s dynamic quoting capabilities. From creating detailed quotes to offering flexible pricing options and securing instant approvals, Smart Service automates every step of the sales process.

Do the work

Go mobile and close the paperwork gap with Smart Service. Streamline work order management by allowing technicians to access schedules, update job statuses, and submit digital forms right from their mobile devices.

.webp)

Get paid

With automated invoicing and secure payment processing, businesses can collect payments faster—whether on-site or online.

Work smarter not harder with smartservice

work smarter, not harder

Workflows That Work the Way You Do

Workflows That Work the Way You Do

.webp)

.webp)

.webp)

Every business has its unique way of operating, and Smart Service is built to enhance that uniqueness. Other solutions require you to conform to their workflow. Say no to rigid workflows that force workarounds. Say yes to powerful, flexible workflows that optimize your business at every step, maximizing efficiency and profitability.

Work smarter not harder with smartservice

industries

Platform that adapts to the specific needs of your business

Designed for the Trades,

Built for Your Success

No two trades are alike, and neither are their challenges. That's why Smart Service offers flexible workflow solutions that adapt to the specific needs of your business. Empower your business with tools that are as unique as the work you do.

Choose the solution built to support the way you work, streamline your operations, reduce inefficiencies, and enhance profitability.

Work smarter not harder with smartservice

features

Elevate your operations with Smart Service and unlock limitless growth.

Unlock your business's full potential with a platform that offers limitless possibilities. Smart Service integrates cutting-edge features into one seamless solution.

one platform

limitless possibilities

Take on more jobs while reducing overhead and administrative burdens.

Work smarter not harder with smartservice

Customers say

What do our customers say about Smart Service?

the real story straight from our customers.

“It’s an excellent, excellent product.”

Work smarter not harder with smartservice

INSIGHTS & ANALYTICS

Transform Your Business with Actionable Data to Drive Growth and Efficiency

decisions

Smart Service Provides

the Insights to Lead

the Insights to Lead

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)